Hong Kong to launch e-bill payment in 2013

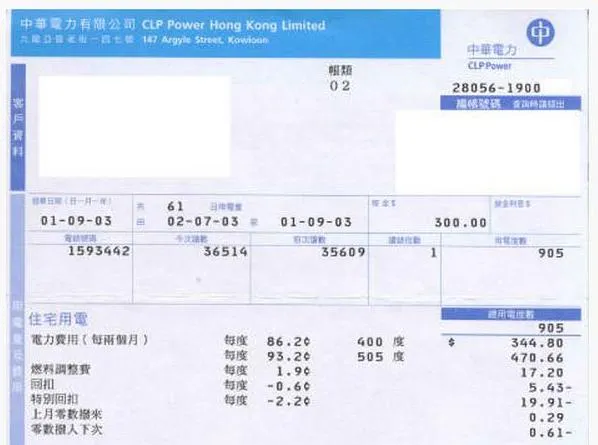

An electronic-bill payment system will greatly facilitate local and cross-border yuan bill payments made by Hong Kong residents.

To be launched in 2013, the system will enable residents to receive, manage and pay e-bills on a single platform. It will also give them full control of the bill payment process. The Hong Kong Monetary Authority invested HK$17 million to develop the e-bill payment system.

HKMA Deputy Chief Executive Pater Pang said some 10 local banks have shown an interest in joining the e-bill system. He said the e-banking clients of these 10 banks represent nearly half of the total e-banking customers in the city. He assured residents that HKMA will ensure that the highest security standards are applied to the e-bill payment platform.

'With the support of the banking sector, we are confident that the retail payment infrastructure in Hong Kong will continue to make good progress and enter in a new era of diversified retail payments, thereby reinforcing the position of Hong Kong as an international finance centre," Pang said.

Besides the e-bill system, HKMA will also conduct a feasibility study on the adoption of an e-cheque payment system in the city. HKMA could launch the e-cheque payment system in 2014 after the feasibility study is finished at the end of this year.

Hong Kong has a high penetration rate for e-banking. The average number of e-banking accounts grew 22% annually in the last 10 years. In 2011, there were 7.6 million individual e-banking accounts and 660,000 business e-banking accounts.

In the second half of 2012, the average monthly transaction value handled by individual e-banking accounts reached HK$413 billion while the average monthly value handled by business e-banking accounts totaled HK$4,013 billion.

Advertise

Advertise