Hong Kong bond issuers most active in Asia

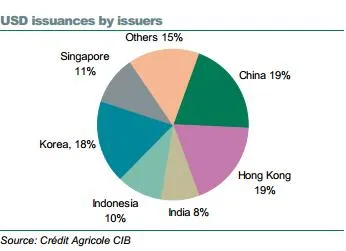

Hong Kong accounts for 19% of the USD77.8bn-worth of USD bond issuances in Asia ex-Japan.

Here's from Crédit Agricole CIB:

Entering into 2012, G3 bonds issued in Asia ex-Japan picked up rapidly. USD bond issuance (public offers that we track) amounted to USD77.8bn YTD, compared with USD56.6bn for the whole of 2011. Issuance has been supported by demand for credits in search for higher yields, especially amidst low USD rates and UST yields.

The latest bout of quantitative easing from the US has further added to Asian USD bond market momentum. Though the market looks a little bit crowded, demand should remain in the near-term.

Subsequently, potential flows from issuers to swap USD proceeds into local currencies could pay up local currency basis/CCS. In some cases, if the issuers would like to swap from a USD fixed rate to a local currency fixed rate – depending on their needs and views on the markets, then local currency interest rate swaps would be paid up as well.

Hong Kong issuers have been the most active, along with Chinese issuers, in the Asia ex-Japan USD bond market so far this year. Related swap flows, together with generally tight HKD liquidity, have paid up the USD-HKD basis (Hi-Li) at different segments of the curves upon various driving forces in the past few months.

We reckon that not all of the recent USD proceeds have been swapped. For the USD bond issues in September and so far in October, tenors have been more or less evenly split between 5Y and 10Y in terms of issuance volume. However, the HKD basis curve has been on a steady steepening trend since mid-September, with the 5Y/10Y spread reaching +12bp on 17 October 2012, the widest in more than nine years.

We therefore recommend investors receive a 5Y/10Y USD-HKD basis spread at +12bp, with a target of 0bp and a stop loss of +18bp. The carry is at a negligible -0.4bp on a 3M horizon.

Steepening in the USD-HKD basis curve looks excessive

These swap flows have not led to much paying interest in HKD IRS yet, suggesting a portion of the funds remain on the floating rate side. We would be monitoring HKD IRS to see if there is any opportunity to pay rates going forward. However, given the low USD and HKD rates environment, these funds may well stay on the floating rate side for a while.

Advertise

Advertise