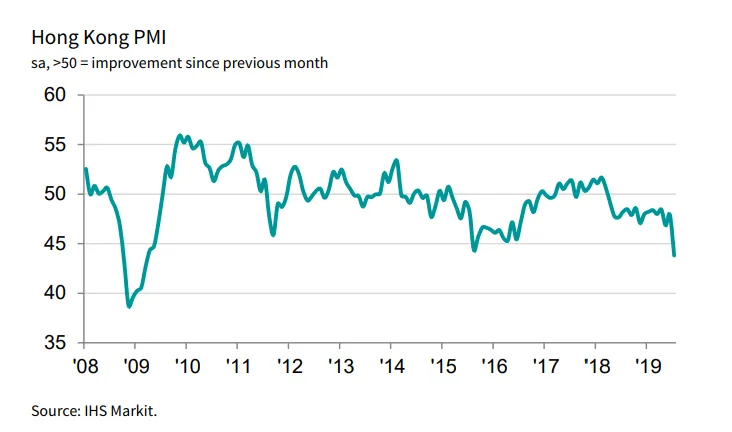

PMI sinks to decade-low 43.8 in July

This is due to sharp declines in both business activity and new orders and fall in input stocks.

Hong Kong faced the steepest detorioration in private sector health since the height of the global financial crisis as the Purchasing Managers Index (PMI) sank to 43.8 in July from 47.9 in June, according to IHS Markit.

Also read: GDP growth holds firm at 0.6% in Q2

"The rate of decline in both new orders and business activity was the steepest for over a decade, reflecting worsening demand conditions brought on by an ongoing US-China trade war and an escalation in large scale political protests in Hong Kong,” Bernard Aw, principal economist at IHS Markit, said in a statement.

The Nikkei Hong Kong PMI is a leading indicator of economic health that gauges business conditions in the private sector. PMI readings below 50 represent an economic contraction.

Aw noted that business confidence fell to its lowest point since January 2016 with the Future Output Index, a gauge of business confidence, sinking to the lowest level for the past three-and-a-half years. Firms are reportedly concerned over trade uncertainties as well as the ongoing protests, causing lower output expectations over the next 12 months.

The current social and economic situation also dampened demand for Hong Kong's goods and services in July, survey data revealed. Inflows of new businesses fell at the fastest seen for over a decade, partially weighed down by reduced Chinese demand which declined at the steepest rate in nearly four years in July.

Also read: Retail sales fall 6.7% to $35.2b in June

Survey respondents also noted that lower sales and a pessimistic business outlook led to a sharp fall in stocks.

The survey also found signs of deflation at the start of the third quarter. Purchase costs for inputs fell despite a steady rise in wages; whilst, firms lowered their selling prices for the first time in three months, which reportedly reflected efforts to clear stocks and attract new clients.

Overall, Aw said that Hong Kong’s private sector faces an increasingly gloomy outlook for the third quarter with survey results indicating economic contraction."The survey is now broadly indicative of the economy contracting at an annual rate of around 2.0%."

Advertise

Advertise