Grade-A office rents fell 1% to $160 psf in May

Most of the deals in Central were in the small or mid-scale level of below 15,000 sqft.

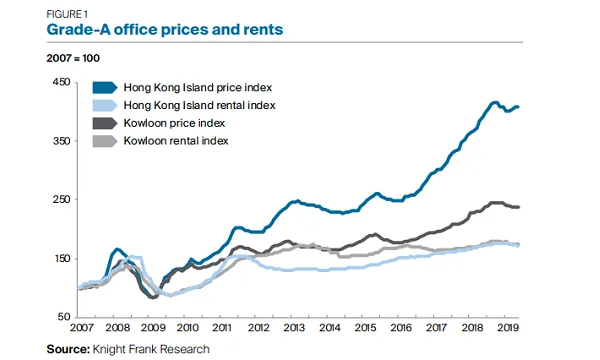

Grade-A office rents in Central slipped 1% MoM to $160 psf in May as leasing momentum continued to weaken in response to t escalating China-US trade war and local political tensions, a report by Knight Frank revealed.

Transaction volume in the area was also impacted, with most of the deals recorded in the small or mid-scale level of below 15,000 sqft as office tenants withhold leasing decisions. “As concerns increase for economic uncertainties and rising vacancy in Central and Admiralty thanks to large decentralisation moves, rental growth in the Central Business District (CBD) is expected to remain sluggish as both tenants and investors will remain cautious in the near term,” Knight Frank Greater China’s director and head of research and consultancy David Ji said.

Also read: Grade A office net absorption slumps to 167,100 sqft in Q1

Meanwhile, Kowloon’s Grade-A office market remained highly active in May, with the number of transactions soaring 65% MoM, the report noted. Most of the deals were recorded in Kowloon East with an area of 6,000–7,000 sqft. In the first five months of 2019, half of the transactions over 20,000 sqft were recorded in Kowloon East, driven by demand from shipping, logistics and electronics companies.

Also read: Hong Kong Island's pricey office rents push cash-short tenants to Kowloon

One of the significant leasing deals recorded during the month was FT Life Insurance Company’s letting of four floors, totalling 126,000 sqft, in NEO in Kwun Tong. The company will reportedly lease the office space for a monthly rent of around $26–28 psf, averaged after calculations of various incentives, Ji said.

“It is noteworthy that landlords are divided in terms of attitudes and strategies to alleviate the negative factors. Some have remained firm in rents despite lingering trade war concerns. Other landlords have been wary of its impact on businesses in the area and started to provide more incentives to lease out vacant office space,” he highlighted.

Advertise

Advertise